Rewriting the Script for Investor Relations Recruitment

May 19, 2022 – Not long ago, veteran executive recruiter Smooch Repovich Rosenburg came to her latest client, a global technology company, with a group of candidates for a pivotal investor relations officer role that had now come down to three finalists. One prospect had not yet served as an IRO, but was ready to make the transition; another had a significant background in global management consulting before making the move to investor relations; and the third candidate was a sitting head of IR. Throughout the search process, the chief financial officer favored the third candidate as this individual represented the “easy choice.” But Ms. Repovich Rosenberg pushed back. “I remember saying to him, ‘Really? That’s the reason you want to make a hire?’ I wanted to remind him that the easy choice isn’t always what is right.”

The recruiter urged her client to give the second candidate a harder look. This person might seem like an odd choice, she said, but actually brought something completely different to investor relations. As it played out, the client wisely followed her advice and chose candidate No. 2. Later, Ms. Repovich Rosenberg remembered the CFO telling her that he had “never had a search partner who thinks holistically— most search firms just want to find someone who will fit the box on the organization chart.” To which Ms. Repovich Rosenberg replied: “That’s just not who I am.”

Distinctive Record

To the uninformed, Ms. Repovich Rosenberg is founder and CEO – or as she puts it, chief talent solutions innovator – of Los Angeles-based SmoochUnplugged LLC, which she launched last year. With her distinctive moniker and decades-long track record in investor relations and communications executive search, most recently at two globally recognized search consultancies, Ms. Repovich Rosenberg provides her private equity and corporate clients with searches for investor relations officers and chief communication officers, along with strategic advisory services. Her firm’s portfolio spans clients in all industries and all sectors of the public company journey from pre-IPO to mega-cap entities.

Filling a Critical Void in PE

When Ms. Repovich Rosenberg designed SmoochUnplugged, she wanted to build a contemporary, forward-thinking firm that would fill the void in the search industry when it comes to recruiting IROs and CCOs. The investor relations officer, in particular, is becoming one of the most critical positions within the private equity sector, she says, and demand for the role will only grow in the years ahead.

“I have intentionally spent a lot of my time over the past couple of years building relationships with private equity firms,” Ms. Repovich Rosenberg said. “It’s a universe I am truly interested in, due to our specialty and concentration in investor relation officer searches, and after spending this time, it’s clear that we can add value and help PE firms with their portfolio companies quite easily.”

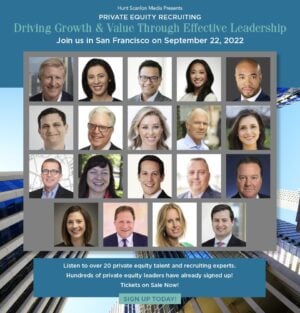

Spotlight: Redefining the Search Sector for PE Leaders

Spotlight: Redefining the Search Sector for PE Leaders

Smooch Repovich Rosenberg is the founder and CEO of Smooch Unplugged. She brings strategic investor relations officer search consulting focus to the PE arena as a means to helping firms realize their

portfolio company valuations as these entities contemplate entering the public markets. Her 30-plus year collaborating with pre-IPO companies across industry sectors is one of the most unique search consulting strategies in the marketplace. Working with PE firms’ portfolio companies and other pre-IPO companies across North America, Europe, and Asia has been a brand enhancer for her as an expert in the capital markets and the deep and broad investor relations officer search work she and her team conduct.

Ms. Repovich Rosenberg recently sat down with Hunt Scanlon Media to discuss her approach to finding top PE talent and how her firm works with clients. Click here to read the full interview.

What makes her firm unique outside of its focus is that SmoochUnplugged invests greatly in its own talent. “Everyone in my firm has a very proactive approach to knowing the talent both on a broad basis as well as deep in terms of their own background so that when we launch a search, we don’t do any cold calling,” said Ms. Repovich Rosenberg. “We contact people with whom we have had relationships for years, so we already know what their career aspirations are and the talent and experience that they bring. It’s very easy for us to construct a tightly scripted panel of candidates, any one of whom can hit it out of the ballpark. Since we specialize in this niche, we know the people and we only deal with the top 20 percent of talent around the world, because that’s what our clients expect us to bring them, and it’s the caliber of candidate with whom we like to work” she added.

In every prospect, such as the individual who won the IRO role for the global technology client she cited, Ms. Repovich Rosenberg wants what she calls a “corporate athlete,” a term she lays claim to coining. “When looking to hire, I firmly believe that clients should not be looking to hire a purist for the role, because then you’re just getting one skill-set,” she said. “A corporate athlete is someone who brings broad business acumen to the role on top of the skills needed. This way, they can weigh in on a wide variety of topics for the company and act as a neutral advisor to the CEO and CFO.”

The corporate athlete mindset is one that has become a cornerstone of SmoochUnplugged and something Ms. Repovich Rosenberg says she and her team bring to every search. “Having experiences in different sectors — like management consulting, for example — gives candidates the ability to do so much more than just one thing,” she said. “When I’m placing someone, I’m always looking to do far more than just fill a box or champion the easy choice. I’m looking for what’s next, what is good for my candidate and client, and what is going to help them for years into the future.”

Doing Search Differently

While a number of Ms. Repovich Rosenberg’s placements in the PE space come through traditional processes — a PE firm reaches out with a company in search of an IRO, Ms. Repovich Rosenberg meets with the company, and, more often than not, they partner to find the right individual — others come through a more hands-on, personal approach.

The process begins when PE firms refer SmoochUnplugged to a portfolio company directly, and Ms. Repovich Rosenberg then works closely with the company’s chief executive officer or chief financial officer as an advisor as they begin the journey of considering taking the company to the public markets. Throughout this process, Ms. Repovich Rosenberg acts as a sounding board for the company’s management throughout the process, even before it is decided whether the company will go public or hire an IRO.

“In this second category of search, I really become an advisor more than anything,” Ms. Repovich Rosenberg said. “I’m able to answer the questions of why an IRO is important to the investor community and to the company internally and find out what exactly the company needs. I’m able to really help the company and lend my expertise throughout the process.”

Ms. Repovich Rosenberg is a self-described contrarian, and she has modeled her firm along those same lines. “I have always believed that search could be done differently,” she said. “I don’t believe that this is a transactional line of work. There has to be an investment on the part of the search consultant, not just in answering the client’s questions, but more so in nurturing candidates to help them make smart decisions and being an advocate of theirs.”

Related: Private Equity Firms Invest in Raising Their Talent Game

Ms. Repovich Rosenberg prides herself on being a straight shooter. Having worked in the industry for over three decades, she has considerable experience working with a wide spectrum of clients and knows what works and what does not. “I believe that my ability to share my viewpoint with clients makes me different,” she said. “My role is not to shove a round peg in a square hole and call it good; my role is to help minimize human capital recruitment risk and to influence a client in the decision-making process.”

A Two-Way Street

Ms. Repovich Rosenberg pointed to the fact that CFOs only hire one or two IROs in their entire career. So when that time comes, they want her expertise, and she is happy to oblige. When Ms. Repovich Rosenberg begins an IRO search, she reminds her clients to have an open mind and encourages them to prioritize a candidate’s intangible leadership qualities as opposed to fit on paper or their technical competencies.

“At the end of the day, the technical competencies to do the job well are table stakes,” she said. “Where you get success, in my opinion, is through the alignment of a candidate’s intangible leadership attributes and a cultural fit with the client management team. It’s a two-way street where the candidate can realize their next best career step and my clients can realize the success of their valuation and relationship with the investment community.”

Ms. Repovich Rosenberg said the intelligence of the candidates makes her confident that even without the technical background, they will find their footing rather quickly in an IRO role.

For clients, hiring someone without a specific background can be unnerving, but Ms. Repovich Rosenberg is confident in her ability to help clients come around to her prioritization of fit. “The search process should be and is a learning process for clients,” she said. “It’s really interesting: A client can start at point A, and I know they need to land at point D, and 9.9 times out of 10 they get to point D and are like, ‘Wow, how did we do that?’ It’s because they were active listeners, and they were smart about the decisions that they made. And I’m only able to get them there because I have a voice that is credible with them.”

Related: Private Equity Recruiting and What it Takes to Find the Right Candidates

Contributed by Jonah Charlton, Senior Editor; Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media