Private Equity Recruiting and What it Takes to Find the Right Candidates

May 18, 2022 – For the private equity sector, the 1,704 deals that were made over the first three months of 2022 reflected a 22 percent drop from the same period a year earlier, and a 35 percent decline in value. Venture capital, meanwhile, saw a 13 percent decline in investment, from $184 billion in the fourth quarter of 2021to $160 billion in the first quarter of 2022, according to Crunchbase. However, most executive search firms seemed not to be feeling the pinch, with many saying they were basically experiencing a continuation of last year’s relentless pace. The rapid changes that occurred within companies in recent years due to COVID/ working from home and supply chain issues created the need to find suitable management for these changing circumstances and this fueled a boom in executive search generally, according to Joseph Blass, founder and CEO of Ezekia.

“In some ways, private equity reflects the economy as a whole and perhaps for a variety of reasons needs to adapt even faster to change, so from what we can see, the pressure is to deliver great managers and leaders fast enough to meet demand,” he said. “Moreover, the competition for the right talent is creating salary inflation and genuine chasing of talent. On the positive side, the relatively quick decision-making process of private equity vs. big corporates gives the industry an advantage in hiring the best people.”

Private equity is a fast-moving industry. Data research firm Preqin says that the global private equity industry has $1.8 trillion in dry powder waiting to be deployed. Venture capital dry powder, which grew by $43.1 billion in the first quarter of this year, is at $478.5 billion. This comes in the wake of a remarkable 2021 for PE investors: “Merely saying that private equity deal value set a new record in 2021 hardly does the industry justice,” said Bain & Company’s Global Private Equity Report 2022.

So, what are some of the challenges involved in recruiting within this sector? “Change within the senior ranks at private equity outfits has to occur quickly and deliver with it a measurable impact,” Mr. Blass said. “As a result, there are potentially excellent executives who are nonetheless not suitable for this industry and it is the job of the search firm to find not only great managers for the respective industry of the portfolio company, but also to find those managers suitable to work with private equity owners.”

Mr. Blass elaborates with two examples of the unique skills required to work for private equity: “First, private equity companies are usually well structured and as such need managers with corporate experience,” he said. “On the other hand, as fast moving companies, they need entrepreneurs. It is difficult to find talent that has both corporate experience and real entrepreneurial capabilities (decision making, improvising and so on).”

Related: Private Equity Firms Invest in Raising Their Talent Game

“Secondly, private equity people tend to be financially savvy and run the portfolio companies through a financial prism,” Mr. Blass said. “Many of the people that they are hiring look at businesses from a different angle, and that can create a clash of culture and clash of expectations.”

In-Demand Positions

“From what I can tell, CFOs are always in demand, and for fast growing companies, there’s a demand for chief commercial officers, chief revenue officers, and chief marketing officers,” said Mr. Blass. “Regardless of the role, the skills or even characteristics most in demand for private equity are the ability to adapt and transform. Businesses need to adapt rapidly to selling different and varied services, changing sales channels (for example from physical to digital), and embrace new technology. Managers who can deliver these characteristics are scarce.”

Private Equity Firms Invest in Raising Their Talent Game

Private Equity Firms Invest in Raising Their Talent Game

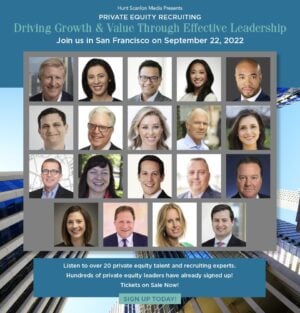

Hiring the right talent is always a challenge. But the recruiters who have the most success tend to be highly disciplined about paying strict attention to the value-creation plan. Join us as we preview this exclusive Bain & Company report — supported by Hunt Scanlon research — and shed light on how PE companies are recruiting the right talent.

Looking forward, Mr. Blass expects this boom in senior-level recruiting to continue for the foreseeable future. “Rapid growth, changing environments and trends, or even threats – political or economic – require constant adjustment, and that translates into an active executive search market,” he said. “Only long-term stability can cause executive search to slow down and I don’t think anyone is predicting stability right now.”

Mr. Blass provides two aspects to look out for in private equity in particular. “Rising interest rates – firstly because private equity relies to some extent on lower interest rates and secondly, running a company in an environment of rising interest rates is uncharted territory for most CFOs,” he said. “The other is diversity and ESG. While private equity is financially driven, the industry will need to adapt to measuring new targets around diversity and ESG. And diversity is not only a gender or ethnicity question, it is also diversity in thinking. “

Mr. Blass leads Ezekia, a provider of software for search firms. The company offers full business development and assignment management tools as well as internal and external reporting, GDPR compliance, and invoicing. Ezekia is fully cloud based and can work from mobile or Mac devices as well.

Related: Leadership Dilemma Unfolding at Private Equity Firms

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media