Shifting Trends in Technology Recruitment

April 7, 2023 – Executive recruiting is a critical aspect of any industry, and the tech sector is no exception. As the demand for talented leaders in the tech industry continues to grow, executive recruitment has become increasingly competitive and sophisticated. In recent years, big tech companies have dominated the executive recruitment scene, luring top talent with generous compensation packages, cutting-edge technology, and unique company cultures. These companies have set the bar high for executive recruitment, and smaller companies are struggling to keep up.

One of the trends we are seeing in the tech industry is a growing emphasis on diversity, equity, and inclusion (DEI) in executive recruitment. With the Black Lives Matter movement and other social justice movements, there has been a call for companies to prioritize DEI in all aspects of their business, including executive recruitment. Companies are now actively seeking out diverse candidates to fill their top positions and are taking steps to ensure that their hiring processes are free from bias.

Another trend is the use of artificial intelligence (AI) in executive recruitment. With the vast amounts of data available to companies, AI can help streamline the recruitment process and identify the best candidates for a given position. AI algorithms can analyze resumes, cover letters, and even social media profiles to identify the most qualified candidates, saving recruiters time and resources.

Furthermore, we are seeing a shift towards remote work in the tech industry, which is affecting executive recruitment. Companies are now able to recruit executives from anywhere in the world, and candidates are no longer limited to certain geographic regions. This has opened up a whole new pool of talent for companies to choose from and has made it easier for executives to find positions that fit their skills and lifestyles.

Related: Technology, Quality, and Quantity in Private Equity Recruiting

Executive recruitment in the tech sector is a dynamic and evolving field and, with the ever-changing landscape of the industry, companies must adapt and be innovative in their recruitment processes to find the best candidates. By prioritizing diversity, equity, and inclusion, using AI and other emerging technologies in recruitment, and embracing remote work, companies can attract and retain top executive talent and remain competitive in the tech industry.

Search Experts Weigh In

“Product and engineering are two of the highest demand functions we are seeing as a firm,” said Katie Fischer, managing director at Daversa Partners. “In this market, in the race to build products that will lead categories and win market share, companies have little room for error in both of these hires and it has created a supply and demand issue where there are a plethora of product and engineering searches but a dearth of candidates. Companies are working to stand out/differentiate in the courting process and taking new and creative measures to attract and hold the attention of top talent.”

“We are beginning to see a shift in the ideal skill sets across product and engineering leadership,” Ms. Fischer. “The narrative of growth at all cost is no longer viable, and historically where companies were seeking leaders who could rapidly scale teams, there has been a shift toward those who can lead nimble, lean and highly efficient teams and organizations. I believe this is going to lead to a new wave of product and engineering leadership across the industry.”

“Given the current uncertainty in the market, many senior executives in the tech sector are opting to stay put in their current roles rather than explore new opportunities,” said Stacy Fitzgerald, principal at Morgan Samuels Company. “This has created a tighter supply/demand dynamic for executive talent, particularly at the senior level. Companies are finding it more challenging to attract and retain top talent, and are having to be more creative in their recruitment and retention strategies to stay competitive.”

“At Morgan Samuels, we’re using AI to enhance our executive recruitment process, not replace it,” Ms. Fitzgerald said. “We see it as an aid, something that can help us more efficiently and effectively identify and attract top talent. For example, we’re using AI to spot trends and filter candidates, which can save us time and improve the quality of our search results. Additionally, we’re leveraging AI to gain insights into the specific issues hindering role performance in certain industries. By doing this, we’re able to better understand the unique challenges our clients face and provide them with tailored solutions. So, while AI is certainly changing the way we work, it’s important to remember that it’s not a substitute for human expertise and judgement.”

“One of the biggest challenges we face when it comes to finding senior executives in the tech sector is identifying individuals with the right combination of technical expertise and leadership skills,” said Ms. Fitzgerald. “Additionally, the demand for diverse talent is growing, and finding qualified candidates from underrepresented backgrounds can also be a challenge. At Morgan Samuels, we work closely with our clients to understand their specific needs and help them overcome these challenges to find the best candidates for their organization.”

“Right now we are seeing a Big Tech market in different shape to ever before,” said Tim Baker, partner at Wilton & Bain. “Some of these companies have only experienced rapid growth and unfettered hiring, for the first time ever, they are going through a reduction on force, often without the experience to execute it well and ensure engagement levels stay high.”

“As a consequence, organizations in other sectors who have often looked for this talent without success, such as energy, oil & gas and financial services, have access to talent they have not typically been able to attain without significant effort and time,” said Mr. Baker.

“The biggest trend I have seen in the last three to six months that is particularly different than the last two years is the emphasis on talent that has a near term ROI to it, such as sales, business development, demand generation marketing, customer success and FP & A,” said Mike Silverstein, managing partner of healthcare it & life sciences at Direct Recruiters, Inc. “Investors are demanding greater discipline from their portfolio companies as the cost of capital has increased and the bottom has fallen out of company valuations – particularly in tech. No investor wants their portfolio company to have to go out for a fund raiser right now for fear of a down-round and as a result, every company is having to show a path to break even and/or profitability, which over the last couple years hasn’t been the focus.”

“During the grow at all costs period that started in late 2020 and continued through fall of 2022, capital was cheap, and companies were doubling down on product talent focused on innovation that was to be delivered by expensive and newly hired engineering and data-talent,” he said. “That has slowed tremendously in recent months and has been coupled by significant layoffs across most of big and medium tech. What felt like an inelastic demand for tech talent over the last number of years, that corresponded to growing compensation demands has really flipped. There is now an abundance of tech talent on the street with far less demand for its services.”

“The most interesting use of AI that has crossed my path recently is the use of ChatGPT to create role descriptions and reporting almost instantly,” Mr. Silverstein said. “This has always been very cumbersome and time consuming. We are still early in our exploration of these tools but the ability to save time on more administrative type tasks is really intriguing. We also are heavy users of AI Driven, data tools such as HireEZ and other more common tools like LinkedIn etc. that have helped streamline our research and sourcing efforts.”

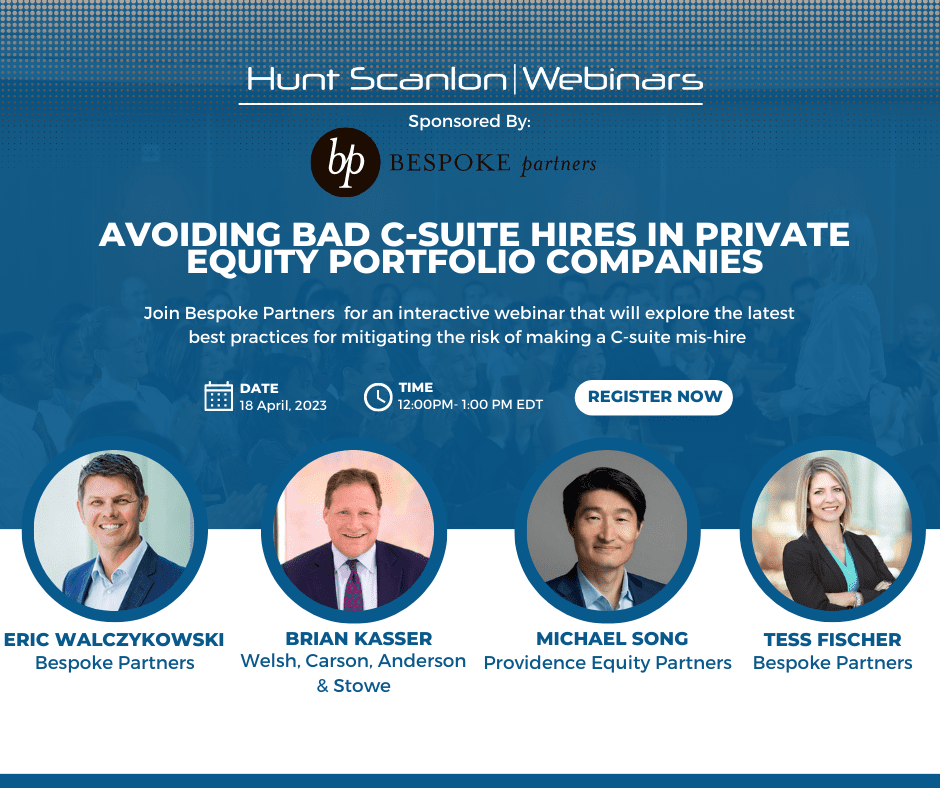

“One of our specialties is in recruiting C-level executives for software and SaaS companies backed by private equity,” said Eric Walczykowski, chief executive officer of executive search firm Bespoke Partners. “The flood of private equity deals in the latter part of 2021 created huge demand for seasoned tech executives through most of 2022. While much of that surge in hiring is past, we are still seeing high demand for executives when you compare it to historical averages. This high demand has made the sector a seller’s market, meaning executives are in the driver’s seat and can demand higher and higher compensation packages to move to a new role. So, we have seen a rise in average salaries, bonuses and equity packages.”

“The tight market of course means that seasoned executives may cost a premium to bring on board,” said Mr. Walczykowski. “But beyond this, it’s important to look at candidate alternatives outside of the traditional pool of experienced private equity executives. That can be hard to do unless you have an expansive network of technology executives and the domain expertise to recognize non-traditional executives who can be successful in private equity. Most search firms simply don’t have that network or expertise.”

“Specifically, we are seeing major success with helping our clients to find and recruit step-ups who then go on to create huge value for their portfolio companies,” Mr. Walczykowski said. “This might be a VP of FP&A who is ready to move up to the CFO seat. Your typical search firm won’t even look at that candidate because they have not held the CFO title before. But our SRG methodology, AI-assisted candidate research, and our domain expertise in private equity leadership allow us to recognize the clues that indicate these executives are ready.”

“Demand remains strong for tech executives. And it is especially strong for leaders with hands-on management styles and high emotional intelligence, who tend to be most adept at moving organizations forward in today’s modern workplace, often marked by large portions of employees working remotely,” said Rick DeRose, co-founder, managing partner, and leader of the technology practice of Acertitude. “These skills lend themselves to collaborating with C-level peers, creating organizational synergies, being emotionally attuned to employees, and managing change quickly, which are so important within a complex and fast-paced business environment. These competencies, taken together, are what characterize leaders capable of driving high performance and shaping successful businesses in the technology sector.”

Mr. DeRose says that some challenges for finding senior executives in the tech sector are execution. “With M&A slowing down, both tech-focused private equity firms and portfolio companies in the industry have shifted more of their focus to driving operational excellence,” he said. “We are consequently seeing highest demand for leaders with proven experience modernizing operations, enhancing cyber protection, and driving investment returns in these areas.”

“On the demand side, we’ve seen a marked increase in the number of CEO, CFOs, and sales leadership roles,” said Kevin Barry, managing partner at SPMB. “This is reminiscent of trends witnessed nearly 20 years ago post the dot-com bust, but not what we experienced post the 2008 financial crisis. What we’re seeing today is founders and CEOs that have weathered the largest pandemic in 100 years and are now navigating formidable economic conditions that are either electing to step aside for more experienced CEO leadership, or are looking to hire strong number twos to partner with them in building their business in these challenging times.”

“With regard to CFOs, the need for financial stewardship and a steady hand on the tiller is heightened in challenging macroeconomic conditions,” Mr. Barry said. “The focus for many growth-stage companies is on making sure they have the right financial leadership in place to extend runway, manage costs, optimize margins, and proactively anticipate what is around the next corner.”

Like in past downturns, sales leadership projects are spiking relative to other functions as well, according to Mr. Barry. “Growth and revenue is a top priority for earlier stage startups and growth stage technology companies,” he said. “As such, many companies are making moves to uplevel their sales function to help reinvigorate growth in very challenging conditions.”

“Conversely, if a company finds itself contending with any of the aforementioned related challenges, then a candidate has the stronger position within the recruiting process,” said Mr. Barry. “With regard to the candidate community, one theme we’re seeing over and over again is the depth of diligence from sophisticated executives in today’s environment; it’s at a level we’ve never seen before. Specific candidate diligence ‘asks’ include historical board materials, financials including cap table and strategy docs, operating plans, and forward looking pro forma models. In fact, the customary expectation on the part of candidates today is that a data room, or something of the like, will be set up to provide such information and this request is coming much earlier in the search process.”

“As an AI-native company, our firm was founded just over four years ago with the core mission of improving executive hiring outcomes through the innovative application of AI,” said Henry Nothhaft, president and chief operating officer of Alioth. “Our approach not only redefines the traditional recruitment lifecycle but also expands our solution set and value proposition well beyond that of a traditional executive search firm, ensuring that our clients benefit from more efficient searches, data-informed hiring decisions, and improved outcomes for all stakeholders.”

“Through our AI-powered tools and methodologies, we are able to generate and analyze vast amounts of data in order to develop the search strategy, prepare the client, identify the best candidates, make data-driven recommendations that reduce bias and enhance transparency, and even drive the onboarding and integration of the newly hired executive,” Mr. Nothhaft said. “Executive search is and always will be inherently about people, and our use of AI is centered around improving outcomes for our clients, candidates, and placed executives.”

“There is a still a strong demand in senior executives in the tech sector. We see the most active area in the private equity-backed software space,” said Sal DiFranco, managing partner, global advanced technology practice at DHR Global. “Private equity firms are continuing to optimize their investments and driving towards events and are in need of key talent to create an impact. We are seeing many shifts at the top with CEO-level positions, which in turn tends to also increase the need of functional C-suite roles reporting to the CEO. As CEOs enhance their leadership teams after joining an organization, that can create a need for search and leadership development services to support the CEO as they refine their team.”

“There is a still a strong demand in senior executives in the tech sector. We see the most active area in the private equity-backed software space,” said Sal DiFranco, managing partner, global advanced technology practice at DHR Global. “Private equity firms are continuing to optimize their investments and driving towards events and are in need of key talent to create an impact. We are seeing many shifts at the top with CEO-level positions, which in turn tends to also increase the need of functional C-suite roles reporting to the CEO. As CEOs enhance their leadership teams after joining an organization, that can create a need for search and leadership development services to support the CEO as they refine their team.”

“Technology has continually impacted the search market allowing us to work a search faster,” Mr. DiFranco said. “Tools and platforms like LinkedIn fundamentally changed the recruiting market and new solutions like AI can be very useful tools in identifying talent. However, clients continue to value our services as an extension of them – vetting not only resumes using technology tools, but relying on our expertise in vetting candidates and the impact they have had on an organization.”

“Technologies such as AI will be embraced by search firms to help us source candidates faster, but cannot solely be relied on to run a search for us,” said Mr. DiFranco. “In executive recruitment, AI technology cannot evaluate the soft skills of an executive to qualify style, engagement of the candidate, presentation, and communication style (do they look at you in the face, are they paying attention to the conversation, how are they listening, are they long winded in their answers or clear and concise, etc). Executive recruiters have become experts in evaluating candidates human characteristics – are they humble, genuine, or authentic. AI cannot replace that.”

Related: Finding and Keeping Top Tech Talent

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media