Executive Search Industry Grows In U.S.

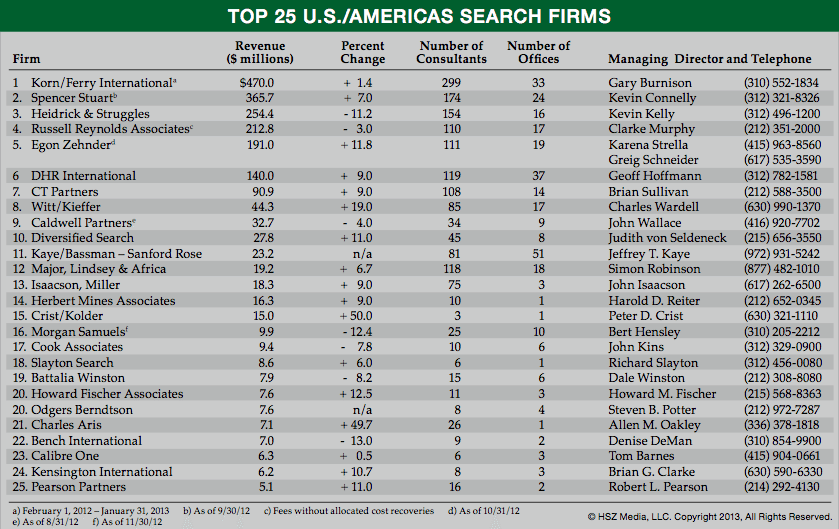

August 14, 2013 – Executive search trend data compiled by Hunt Scanlon Media shows an industry growing domestically, declining globally and struggling with changing dynamics within its core recruitment service offerings. The Executive Search Review 2013 rankings study released by HSZ Media reports that the top 25 U.S. and Americas search firms grew by nine percent last year; the top five global firms declined by four percent; and revenue at the 10 largest headhunting firms gained nine percent, topping out at $1.8 billion in revenue. Specialist firms in retail, non-profit, financial officers and healthcare/life sciences all reported gains. “An ability to search for chief marketing officers and chief financial officers who can navigate companies through tough times is in high demand right now,” said Christopher W. Hunt, an Hunt Scanlon Media director who coordinated the report’s findings.

Egon Zehnder was the only top five firm to grow here by double digits and the firm continues to beat out rivals for important U.S. CEO and board recruiting work. Spencer Stuart’s growth slowed slightly but the firm managed to add another $35 million to its top line in the region in the past year. These were also the only two firms to show growth globally but in both cases it was relatively anemic. The largest talent solutions provider, Korn/Ferry International, posted flat performance in the U.S./Americas and worldwide as it continued to roll out a broad array of talent management offerings. Russell Reynolds Associates and Heidrick & Struggles both posted declining revenue in the Americas and overseas.

The top 25 recruiting firms in the U.S. and Americas matched their performance last year, growing revenues as a group by nine percent. According to data supplied by members of the Association of Executive Search Consultants (AESC) this region accounts now for nearly half of the industry’s worldwide marketshare. The top 25 group broke the $2 billion mark in this recent reporting period, reaching a combined revenue mark of $2.004 billion. Two-thirds of the top 25, or 17 firms, reported positive growth in 2012. Eight firms reported double digit revenue growth. Witt/Kieffer, up 19 percent, continued to see robust strength in its core healthcare and higher education businesses, but with growth in mind the firm launched four new practice areas in board services, life sciences, sports leadership, and exceptional leadership solutions and it took the bold step of launching WK Advisors, a mid-level search division dedicated for now to healthcare; this sector supplies 75 percent of the firm’s revenue base. Howard Fischer Associates, up 12.5 percent, experienced strong growth in its telecomm, media, digital and technology search practices. Howard Fischer, the firm’s president, said this is “one of the most challenging economic periods we’ve experienced in decades.” Chicago-based Kensington International, up almost 11 percent, enjoyed growth in three synergistic businesses: executive search, leadership development and outplacement/ transition services. Managing director, Brian G. Clarke, said the firm’s industrial, chemicals, healthcare and private equity sectors thrived in 2012. Other notable firms with double digit growth: Charles Aris (up nearly 50 percent), Egon Zehnder (up nearly 12 percent), Diversified Search (up 11 percent and on the lookout for potential acquisitions in 2013), and Pearson Partners (up 11 percent). National search boutique, Crist | Kolder Associates, was an exceptional standout, growing its top line by 50 percent to $15 million. With three consultants handling about 50 searches last year, the firm has carved out a strategic niche handling CEO work for mid cap and small cap companies as well as public company CFO assignments. New to the top 25 ranking is Odgers Berndtson, headed in the U.S. by long-time search veteran Steve Potter. Odgers is a relatively new brand in the American market, having grown since its inception three years ago into five offices offering seven functional practice areas. The firm is much better known overseas where it deploys just over 200 recruiters in 51 offices.

Exhibit 1: