Egon Zehnder Recruits CFO for American Equity Investment Life Holding Co.

September 24, 2021 – Egon Zehnder has placed Axel André as the new chief financial officer of American Equity Investment Life Holding Co. (AEL). “I am delighted to welcome Axel to be a part of our executive leadership team. I believe he brings the right combination of intellect, curiosity and proven leadership experiences, to serve as our next CFO as AEL transforms itself into a unique company at the intersection of the insurance and asset management value chain,” said Anant Bhalla, CEO and president of American Equity.

Prior to American Equity, Mr. André was executive vice president and CFO for Jackson National. Before that, he spent nearly seven years at AIG. Mr. André joined AIG initially as chief risk officer for individual retirement, group retirement and institutional markets. He was promoted to CFO of individual retirement at AIG, where he was responsible for overseeing all aspects of the finance and actuarial value chain for the individual retirement business, including asset-liability management, hedging, reporting and capital management. Prior to his time at AIG, Mr. André served as a managing director on the global insurance strategies team at Goldman Sachs. He holds a doctorate in physics from Harvard University and a masters in science in physics from Imperial College in London.

“American Equity is a company on the move,” said Mr. André. “I have watched with admiration its track record of success and look forward to building upon it as we execute the company’s transformational strategy.”

American Equity Investment Life, through its wholly-owned subsidiaries, is a leading issuer of fixed index annuities through independent agents, banks and broker-dealers. The company is traded on the New York Stock Exchange and is headquartered in West Des Moines, IA.

Related: Queensland Investment Corp. Taps Egon Zehnder to Find CEO

Egon Zehnder’s global financial officers practice conducts searches for multinational companies at global, group, regional and division levels. The practice partners with the board and chief executives of all ownership structures — publicly and privately held companies, private equity portfolio companies and family-owned businesses — to help them identify, develop, and recruit the financial leaders. The practice also helps build entire finance leadership teams — including controllers, treasurers and heads of tax, investor relations, corporate development, and internal audit. Egon Zehnder also designs succession plans and builds a pipeline of internal CFO candidates.

New Pressures on CFOs

Immediate concerns around cash flow, liquidity and the bottom line are taking precedence at many companies due to continued fallout from the pandemic. But there are high-value lessons emerging from the current health and economic crisis that chief financial officers should bear in mind, according to recruiters specializing in finding talent for finance functional roles.

‘2021 Hunt Scanlon Financial Services Recruiting’ Special Issue

‘2021 Hunt Scanlon Financial Services Recruiting’ Special Issue

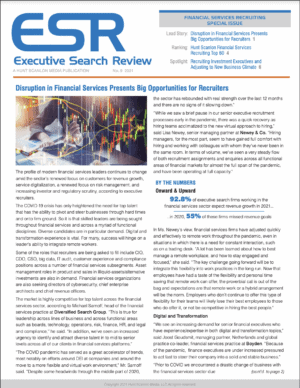

Executive Search Review has just released its 2021 Financial Services Recruiting special issue newsletter! The profile of modern financial services leaders continues to change amid the sector’s renewed focus on customers for revenue growth, service digitalization, a renewed focus on risk management, and increasing investor and regulatory scrutiny, according to executive recruiters. The COVID-19 crisis has only heightened the need for top talent that has the ability to pivot and steer. businesses through hard times and onto firm ground. So it is that skilled leaders are being sought throughout financial services and across a myriad of functional

disciplines.

Hunt Scanlon presents its annual roundup of the 60 most prominent executive search firms serving the financial services sector. Click here and enjoy!

The COVID-19 crisis has thrust CFOs into the spotlight as never before, they report, while the pandemic itself has also created a business environment in which CFOs are uniquely positioned to drive business value during the recovery phase, which is expected to come in 2021 and 2022.

All too many companies today are desperate to get as much cash on their balance sheets as possible in order to ride out the storm of COVID-19, say recruiters. Bottom-line pressures are forcing many businesses to shift their forecasting strategies, explore new products and services — or even expand into alternative sales and delivery channels. The best CFOs are spearheading that effort.

Related: Egon Zehnder Recruits Chief Talent Officer for Netflix

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media