Russell Reynolds Associates Tapped by Taylor Morrison to Lead CFO Search

July 14, 2021 – Chief financial officers continue to be in high demand. Finding them is keeping many of the nation’s top recruitment operations busier than ever. In recent months, search firms of all varieties have placed CFOs at various companies.

Russell Reynolds Associates was recently called in by Taylor Morrison to lead in its search for a new CFO. Current CFO Dave Cone intends to retire from the company once a successor has been named.

“Building upon the positive momentum Dave has helped us achieve, we expect to drive meaningful return accretion in coming years,” said Sheryl Palmer, chairman and CEO. “We are well positioned to create shareholder value as we increasingly capture the synergies from our multiple acquisitions and leverage our consumer-centric portfolio amid today’s remarkably strong housing market. We look forward to welcoming a new chief financial officer with the experience to help propel our company to the next level of performance alongside our tenured leadership team.”

The new CFO will be expected to meaningfully contribute to the company’s strategic vision of generating attractive, sustainable shareholder returns through operational excellence and capital efficiency.

Headquartered in Scottsdale, AZ, Taylor Morrison operates under a family of brands—including Taylor Morrison, Esplanade, Darling Homes, William Lyon Signature Series and Christopher Todd Communities built by Taylor Morrison. It serves a wide array of consumers from coast to coast, including first-time, move-up, luxury and 55-plus active lifestyle buyers.

Russell Reynolds Associates is a global leadership advisory and search firm. Its 425-plus consultants in 46 offices work with public, private and non-profit organizations across all industries and regions. Ranked by Hunt Scanlon Media as the third largest search firm in the Americas, Russell Reynolds Associates earns annual revenues of more than $436.6 million.

Expanding Role

The aftermath of the pandemic is creating additional dimensions in a CFO role that has already evolved significantly in recent years, said Kent Burns, president of Simply Driven Search, a member of Kaye Bassman Sanford Rose Network. “Leadership and mentoring are more challenging with COVID-driven virtual work. Soft skills and EQ in a CFO are more critical now than probably any time in history. The world-class CFOs I speak with understand the unprecedented importance of making relational dynamics a high priority on a daily basis.” The little things are not little things right now, he said.

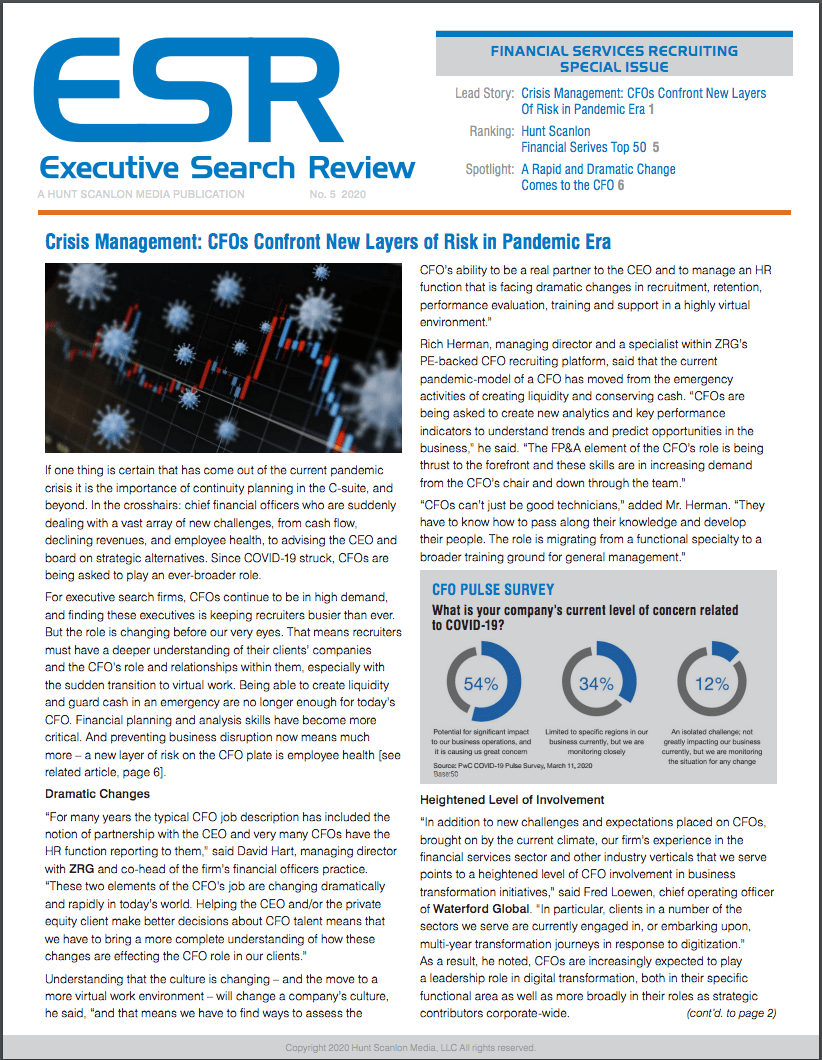

Executive Search Review Special Issue: Financial Services Recruiting

Executive Search Review Special Issue: Financial Services Recruiting

Hunt Scanlon Media has just released our latest special issue of ESR. This time around we take an in-depth look at the challenges financial services firms are facing in their hunt for new talent.

We cover it all: How CFOs are confronting new layers of risk in the pandemic era; the rapid and dramatic change coming at the CFO; using people analytics to acquire top talent, predict performance & reduce turnover; and why banks are turning to search firms. We even provide our latest “Financial Fifty Recruiters” ranking of financial services search firms! In this special issue of ESR, Hunt Scanlon editors take an extraordinary inside look at recruiting during these unprecedented times. Click here and enjoy.

At the core, the risk factors are dramatically different as survivability of the business becomes Job 1. “The health and well-being of the leadership team has become paramount,” said Bernard Layton, managing director at Comhar Partners. “At the end of the day, the role of CFO is now a wisdom strategy and risk management role. That risk management portion of the role grows here as well as advising where to go with the business. And ultimately protecting cash is going to be a key for survivability of the business.”

CFOs, he said, are apprising the CEO of various scenarios vis-à-vis planning and managing around various business outcomes, Mr. Layton said. “They’re also mentoring and managing a team that has their own scope of responsibilities, controllership cash, treasury, financial planning, analysis and so on. In many cases, they’re even performing a human resources role, i.e., reporting in and keeping the team upbeat, motivated and looking past their own concerns towards the broader business objectives – these are all part of an expanding and challenging role.”

The job profile of the CFO will remain relatively stable, but the focus will shift,” predicted Benedikt Rinio partner and chief marketing officer of the global board at Ward Howell. “Experienced, proven CFOs are preferred as there is currently no time to develop into the CFO role or corporate processes.”

In his view, the CFO has morphed into a chief performance officer, who intervenes in the management and analysis of corporate processes, Mr. Rinio said. “In order to do this, he or she needs to know the business even better and give concrete impulses for improvement. Therefore, it is not just a matter of gathering knowledge and insights, but also of supporting the implementation. This demands a lot from the CFO as well as the entire organization. This transformation will shape the coming years.”

Related: Crisis Management: CFOs Confront New Layers of Risk in Pandemic Era

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media