Daversa Partners Recruits CFO for Mint House

February 10, 2022 – Daversa Partners, which helps build leadership teams for growth and venture-backed companies, has assisted in the recruitment of Samantha Greenberg as the new CFO for Mint House, a tech-enabled residential hospitality company. Partner Peter Baiocco led the assignment. “Samantha is a highly regarded finance leader and investor, having established a longstanding track record at firms including Goldman Sachs and Citadel,” said Will Lucas, founder and CEO of Mint House. “She brings years of financial and investment experience and deep understanding of consumer and technology businesses to Mint House. We are thrilled to welcome her as our new CFO as our portfolio continues its rapid growth, more than doubling our markets in the coming year.”

Ms. Greenberg was previously a portfolio manager at Citadel, managing a technology investing portfolio. She has been an investor in technology and consumer companies for the past 20 years. Prior to joining Citadel, Ms. Greenberg founded and ran SEC-registered investment management firm Margate Capital Management LP, growing it into the third largest female-run hedge fund in the U.S. At Margate, she led investor relations and capital raising, financial planning/forecasting and supervised the firm’s operating processes in addition to managing a portfolio and team of analysts investing in technology and consumer businesses. Ms. Greenberg has been named to Ernst & Young’s “50 Leading Women in Hedge Funds,” Institutional Investor’s “Hedge Fund Rising Stars,” and Stanford Graduate School of Business’ “Top 100 Alumni in Investing & Finance.”

“Mint House combines the best of a hotel, without the uninspired space, and the best of an Airbnb, without the inconsistency and uncertainty,” said Tige Savage, managing partner at Revolution Ventures and Mint House board member. “Samantha combines the best of a finance executive with the best of a capital markets expert, adding to an already impressive team of executive talent that has been laser focused on smart growth. With Samantha on board, the team is even better positioned to disrupt the traditional hotel industry and build the next generation hospitality company.”

Ms. Greenberg joins Mint House’s executive leadership team and will be responsible for leading financial operations across the company, including financial planning and analysis, accounting, capital markets and investor relations.

“Mint House is pioneering a new category of hospitality—delivering highly amenitized, tech-enabled, beautiful spaces that offer the conveniences of home and the reliability of a high-end hotel while removing a hotel’s many frictions,” said Ms. Greenberg. “It’s been particularly impressive to watch Mint House triple in size and meaningfully outperform hotel industry peers during one of the most difficult periods the industry has witnessed. Will and the Mint House team have built a differentiated value proposition in a massive market that’s poised for durable growth and profitability,” she said. “I look forward to partnering with them as we focus on delivering and continually innovating an exceptional guest experience and building long-term value for our customers, investors, employees and partners.”

Growth Stage and VC Recruiters

Daversa Partners, founded in 1993, builds executive teams for growth stage and venture backed companies. Its global footprint spans two continents and eight offices, giving its teams visibility into the entirety of the market. Daversa is dedicated to developing meaningful relationships with entrepreneurs, executives and investors across consumer and enterprise businesses. In addition to its primary location in Westport, Conn., the firm has offices in New York; San Francisco; Washington, D.C.; Orlando, FL; London; and Waterford, Conn. where the firm maintains a data and people analytics facility.

With over 15 years of search experience at Daversa, Mr. Baiocco works within both the software and consumer practices. He has built out the executive management teams for the portfolio companies of top tier venture capital firms, including Benchmark Capital, Sequoia, Revolution, Andreesen Horowitz, Bain Capital, Bessemer, Lightspeed, Kleiner Perkins, Menlo Ventures, Highland Capital, and NEA. His work includes: SproutSocial, Affirm, Draftkings, Instacart, Opendoor and Haus, among others.

New Pressures on CFOs

Immediate concerns around cash flow, liquidity and the bottom line are taking precedence at many companies due to continued fallout from the pandemic. But there are high-value lessons emerging from the current health and economic crisis that chief financial officers should bear in mind, according to recruiters specializing in finding talent for finance functional roles.

‘2021 Hunt Scanlon Financial Services Recruiting’ Special Issue

‘2021 Hunt Scanlon Financial Services Recruiting’ Special Issue

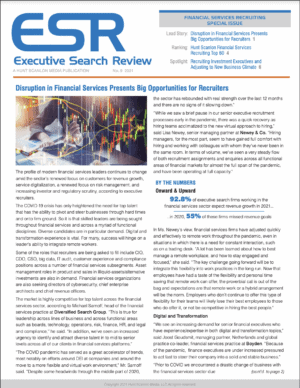

Executive Search Review has just released its 2021 Financial Services Recruiting special issue newsletter! The profile of modern financial services leaders continues to change amid the sector’s renewed focus on customers for revenue growth, service digitalization, a renewed focus on risk management, and increasing investor and regulatory scrutiny, according to executive recruiters. The COVID-19 crisis has only heightened the need for top talent that has the ability to pivot and steer. businesses through hard times and onto firm ground. So it is that skilled leaders are being sought throughout financial services and across a myriad of functional

disciplines.

Hunt Scanlon presents its annual roundup of the 60 most prominent executive search firms serving the financial services sector. Click here and enjoy!

The COVID-19 crisis has thrust CFOs into the spotlight as never before, they report, while the pandemic itself has also created a business environment in which CFOs are uniquely positioned to drive business value during the recovery phase, which is expected to come into 2022.

All too many companies today are desperate to get as much cash on their balance sheets as possible in order to ride out the storm of COVID-19, say recruiters. Bottom-line pressures are forcing many businesses to shift their forecasting strategies, explore new products and services — or even expand into alternative sales and delivery channels. The best CFOs are spearheading that effort.

Related: JDG Associates Begins CFO Search for ACTE

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media