ON Partners Assists Papa John’s with CFO Search

October 15, 2020 – Executive search firm ON Partners has assisted in the placement of Ann Gugino as the new chief financial officer of Papa John’s International. Managing partner Tim Conti, co-founder and partner Josh Nathanson and partner Bryan Buck led the assignment.

“After a careful search for a candidate whose values, passion and expertise align with Papa John’s core values and business needs, I’m thrilled to welcome Ann Gugino to our team,” said Rob Lynch, president and CEO of Papa John’s. “Ann is a proven leader and change agent, who brings deep experience in the consumer and retail sector, including driving demand and profitability across digital and traditional commerce at Target.”

“Ann’s appointment rounds out one of the most capable and diverse leadership teams in our industry,” he said. “The breadth and depth of our team’s strengths, backgrounds and perspectives are crucial advantages for Papa John’s and essential to our long-term innovation and growth plans. Last, I want to thank Steve Coke for providing a seamless transition as interim CFO and leading the finance team during such a momentous period for the company while we conducted this search.”

Most recently, at Target Corp., Ms. Gugino served as SVP, financial planning and analysis, providing overall strategy, guidance and direction in the development and execution of Target’s planning, analysis and capital investment portfolios. Prior to that, she spent 18 years at publicly held Patterson Companies Inc., including four years as executive vice president and CFO. In that role, Ms. Gugino led the company through a major portfolio transformation, including a major acquisition and divestiture, and spearheaded an enterprise-wide effort to improve net margins and create a more efficient cost structure, among other accomplishments.

Based in Louisville, KY, Papa John’s opened its doors in 1984 and is now the world’s third largest pizza delivery company with more than 5,300 restaurants in 48 countries and territories.

Veteran Recruiters

With a primary focus on technology, consumer, industrial and the life science sectors, ON Partners recruits C-level and board talent for public and private companies, as well as venture capital and private equity firms. In 2020, ON Partners was named for the seventh consecutive year named to Inc. magazine’s Inc. 5000 ranking of the fastest-growing U.S. companies. Founded in 2006, the firm’s consultants work from offices in Atlanta; Boston; Chicago; Cleveland; Dallas; Menlo Park, CA; Minneapolis, MN; and San Francisco and New York. ON Partners was also named of the one fastest growing search firms this year by Hunt Scanlon Media. The firm is now ranked as one of the 20 largest search firms in the nation.

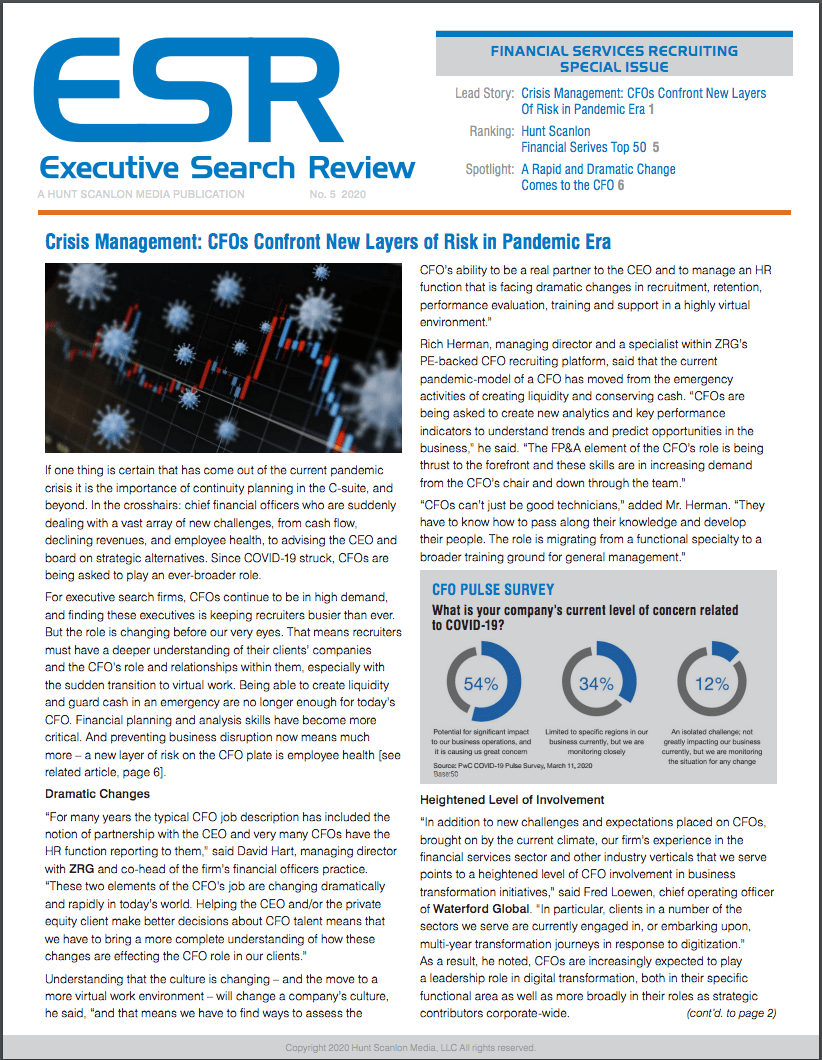

Executive Search Review Special Issue: Financial Services Recruiting

Executive Search Review Special Issue: Financial Services Recruiting

Hunt Scanlon Media has just released our latest special issue of ESR. This time around we take an in-depth look at the challenges financial services firms are facing in their hunt for new talent.

We cover it all: How CFOs are confronting new layers of risk in the pandemic era; the rapid and dramatic change coming at the CFO; using people analytics to acquire top talent, predict performance & reduce turnover; and why banks are turning to search firms. We even provide our latest “Financial Fifty Recruiters” ranking of financial services search firms! In this special issue of ESR, Hunt Scanlon editors take an extraordinary inside look at recruiting during these unprecedented times. Click here and enjoy.

Mr. Conti, who has worked in executive search for more than 15 years, has completed upwards of 150 C-level and board searches across a range of industries. His focus is on public, private equity and venture capital organizations. Mr. Conti also serves as a member of the ON Partners executive committee.

Mr. Nathanson conducts C-level, board and senior executive work across broad spectrum of functions and disciplines. He builds executive teams of publicly-traded and PE-backed organizations.

ON Partners’ Mr. Buck specializes in enterprise technology, consumer products + services and automotive technology sectors. He serves public corporations as well as the portfolio companies of leading PE and VC firms.

Evolving CFO Roles

Since COVID-19 struck, CFOs are being asked to play an ever-broader role. “The tumultuous environment companies are operating within demand a different skill set in the CFO chair,” said Mr. Conti. “CFOs are playing a critical strategic role in companies, not only to pull levers necessary to secure a company’s financial platform, but also to position the company to emerge in a strong competitive positioning in a marketplace where not all will survive. This requires the CFO to lead from the front, be strategic and savvy, to navigate a company through choppy waters. When boards and CEOs do not have confidence that they have this strategic CFO, then they have no choice but to seek out an alternative.”

COVID-19 Creating New Pressures for CFOs

COVID-19 Creating New Pressures for CFOs

For all the hardship that the pandemic has created for companies everywhere, there are valuable lessons to be learned, especially for chief financial offers, says a new report from Tatum. Brad Bauer, vice president with the firm, recently sat down with Hunt Scanlon Media to discuss how CFOs are meeting perhaps the greatest challenge of their careers.

“In times like these, where businesses demand hyper-agility, being a functional specialist isn’t good enough,” said Mr. Buck. “It’s required now that CFOs can see around corners and understand the physical (and digital) trends that are reshaping their world – and then act quickly implement. They need to think like P&L owners – not like accountants. Regardless of the product or service their company offers, customer expectations have changed. And the CFOs in highest demand right now are the ones who have proven to be nimble and business-focused enough to drive organization’s to where the puck is moving (both organically and inorganically).”

This business environment is also putting more pressure on CFOs. “There’s definitely more need for CFOs to operate with transparency around the realities of the market conditions, how those conditions are impacting the business in the short and long term, and what strategic steps are being taken to address the challenges faced,” said Mr. Conti. “Shareholders understand that market conditions are challenging, and they’ll be more patient in these unique times, but only if they have confidence in the CFO’s leadership and strategy.”

“Yes – and it’s industry-agnostic,” Mr. Buck added. “For public companies specifically, those in negatively impacted sectors are trying to survive the rapid slow down, and maintain various levels of ongoing business operations, while planning and positioning for a potential recovery that could happen within the next few quarters…or the next few years,” he said. “Public finance leaders on the other end of that spectrum are seeing tremendous growth and demand, but they’re also cognizant that current share price reflects Wall Street’s expectation of perfection – leaving no room for quarterly missteps.”

Related: BrainWorks Recruits CFO for MackeyRMS

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media