Executive Recruiters Roll Up Their Sleeves as COVID-19 Crisis Unfolds

April 24, 2020 – In mid-March, just as the full impact of the coronavirus crisis was starting to take shape for search firms and other businesses across the nation, Kenneth Vancini, founder of Innova International, an advisory firm for the executive recruitment industry, had a flash of inspiration.

Mr. Vancini had been on the telephone with chief executive officers of search firms from all over, commiserating and offering any advice he could provide, as the leaders looked to better understand the crisis and plan for the rocky road ahead. The leaders were all sharing their thoughts, concerns and insights so openly that Mr. Vancini began to realize how much could be gained if he could bring them all together to talk about the market conditions as related to the pandemic.

Executive Recruiters & Talent Leaders Navigate Uncertain Times

Executive Recruiters & Talent Leaders Navigate Uncertain Times

Hunt Scanlon’s latest executive recruiting industry sector report will be available in 30 days. This will be the most important search industry sector report that Hunt Scanlon has ever produced! The nation’s top executive recruiters are resetting expectations in the midst of an unprecedented global pandemic crisis. Many expect a significant pause in business, followed by a sharp rebound later this year. We talk to the experts, uncover the opportunities, pick the sectors and reveal how search firms and talent organizations are navigating and adapting in uncertain times. Healthcare, biotech, crisis response, supply chain & logistics and the vast private equity sector are all showing signs of strength – and a big need for talent.

Hear from top talent experts, including: Frederickson Partners; CBIZ CMF; Russell Reynolds Associates; Odgers Berndtson; Options Group; ZRG Partners; Wilton & Bain; Diversified Search; Caldwell; Hanold Associates; True Search; Slayton Search Partners; Coulter Partners; Cejka Search; Solomon Page; Acertitude; McDermott & Bull; Academic Search; Beecher Reagan; Bowdoin Group; Kingsley Gate Partners; Comhar Partners; ON Partners; Perrett Laver; CarterBaldwin; Stanton Chase; Buffkin/Baker; Major, Lindsay & Africa; WittKieffer; Klein Hersh; Furst Group; Invenias; PierceGray; LifeSci Partners & more!

Insert an ad in our report, reserve your copy today and find out how you should adapt your business in these uncertain times.

So it was that Mr. Vancini, who previously co-founded ZRG with partner Larry Hartmann, reached out in an email to the 30 search firm CEOs he knew best, asking if they might be willing to join in such a call. As busy as they were, 25 initially said yes. It was so many, in fact, that Mr. Vancini decided to break up the discussion into two calls, for which 23 of the leaders were available at the given times. One of the discussions included 11 leaders and the other had 12.

“So that’s how it came about,” said Mr. Vancini. “It came about as a result of individual conversations with CEOs that morphed into, ‘Hey, we’re all open and honest with our sharing, let’s see if we can get some ideas that the group can share together.’”

The resulting conversations opened a revealing window into the minds of search firm CEOs as they faced the industry’s most daunting challenge in more than a decade. The leaders, some of them direct competitors, spanned the gamut of organizations, from seven-people operations to one with more than 200 employees and $60 million in revenues.

How Recruiters are Mitigating the Impact of COVID-19

In this brand new episode of ‘Talent Talks,’ Hunt Scanlon Media host Rob Adams is joined by Ken Vancini, founder and CEO of Innova International. In this exclusive podcast, Ken discusses the impact that COVID-19 has had on the executive search industry and then explains how industry leaders are using their experiences from past recessions to better mitigate the impact of the global pandemic. Listen Now!

In this brand new episode of ‘Talent Talks,’ Hunt Scanlon Media host Rob Adams is joined by Ken Vancini, founder and CEO of Innova International. In this exclusive podcast, Ken discusses the impact that COVID-19 has had on the executive search industry and then explains how industry leaders are using their experiences from past recessions to better mitigate the impact of the global pandemic. Listen Now!

“It was very transparent and cooperative,” said Mr. Vancini. “Many people on the calls had ridden out the 2001 and 2008 downturns, and everybody was more than willing and open to share their thoughts on how the industry might fare in the situation that we’re going through, and just to share ideas on best practices. There was a lot of very open, honest feedback. The mood of the conversations, I would say, was cautious hopefulness.”

Mr. Vancini said that about 60 percent of the leaders said that they had current job orders that were put on hold, be it for the inability to conduct interviews in person or uncertainty about the future. Upwards of 70 to 80 percent expected a downturn in new searches over the upcoming 30 to 60 days. “Some people were optimistic because they were in the right niche at the right time,” said Mr. Vancini. “But a lot of folks were concerned about a sharp drop off in job orders or searches.” Many were concerned about a potential slow down heading into summer.

Hunt Scanlon ‘Pulse Survey’ Findings

“A lot of folks are still in dialogue for potential new searches,” he said. “I think all of them would be actively pursuing new searches had it not been for the crisis.”

And he’s right. A month on since the Innova International poll, positive sentiment across the executive search landscape is waning. According to a just concluded Pulse Survey conducted by Hunt Scanlon Media, some 49 percent of executive recruiter respondents said they were not optimistic as they looked at the landscape ahead. Just one-quarter of the respondents said they were optimistic. A third hadn’t made up their mind.

The first Hunt Scanlon survey to take stock of the impact that COVID-19 is having on the recruiting sector was far reaching and conclusive: 67 percent of the respondents emanated from search firms in the revenue range of $5-$10 million, 18 percent represented firms in the $10-$25 million bracket, while 15 percent of respondents came from search firms with revenues in the range of $25-$100 million. Two firms reported revenues in excess of $100 million.

Related: Is Hiring on Hold? Not According to Some Recruiters

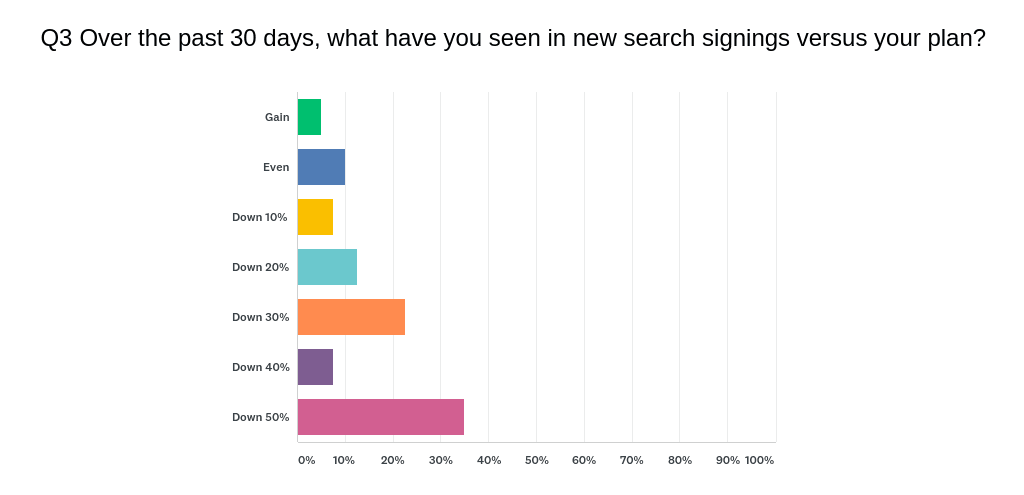

Among the responding group, 33 percent said that new search assignment signings were down by half in the last 30 days; another 44 percent said they were down anywhere from 20 to 40 percent. Just six search firms said they had gained search assignments or stayed even against their plan since the crisis took hold.

While 19 percent of the survey population reported no search assignment cancelations or searches put on hold, an equal number said that half their searches were canceled or put on hold. The rest of the survey group said they have lost or seen anywhere from 10 percent to 45 percent of their assignments pulled back.

Projecting ahead, 61 percent of survey respondents said they expect to see new search signings fall in the next 90-120 day period, as nationwide lockdowns wreak havoc on businesses of every stripe.

Search firms, however, are trying their best to stick to fee schedules – even though a number of respondents reported growing pressure to lower fees, negotiate terms, provide more flexibility on payment terms, and adjust payment schedules. Clients, it seems, at the very least are requesting longer payment terms. Search firms are acquiescing, especially as “a gesture of goodwill” as one respondent said, “for key accounts.”

To that end, “to mitigate the effects of the virus best, most search firms are turning to a client-driven mentality to get through these trying times,” said Erik Boender, head of research and operations for Hunt Scanlon.

As to be expected, 75 percent of survey respondents said they have seen a significant drop in business since the beginning of March, and 81 percent have seen active searches put on hold.

Where activity seems to be holding steady is in e-commerce, e-education, tech platforms, non-profit, board of director searches, food, insurance, biopharma, life sciences, B2B technology, healthcare, some parts of financial services such as credit, telemedicine, consumer products, transportation, software technology, agriculture & food manufacturing, and the sprawling private equity sector which envelops most industry sectors.

One bright spot for executive recruiters, according to the Hunt Scanlon data: Two thirds of the ‘Pulse Survey’ respondents said job losses will be relegated to the lower ranks. The C-suite, they contend, will weather the crisis relatively intact – setting the stage for an expected reversal of fortunes in the fall.

Staying Calm

Brian Clarke, managing partner for Kensington Partners International in Oak Brook, IL, who was on one of Mr. Vancini’s phone calls, said that all of the owners/principals in the conversation that he took part in had experienced previous slowdowns and were prepared to react accordingly, with no real sense of panic. All of the firms, he said, appeared to be relatively well-capitalized with low or no debt and were prepared to hunker down and weather the storm.

“I honestly don’t recall a consensus around how long this was going to last – but, there was absolutely no discussion of the economy coming to the point of where it is a complete shutdown,” said Mr. Clarke. “I believe we were thinking more along the lines of what we all saw in 2008-2009 – a serious, severe slow-down but of a far shorter duration.”

“All firms were capable of and in many instances already allowing / having staffs work remotely,” said Mr. Clarke. “The virtual approach managing the business and projects – assuming the business was there – was really not going to be disruptive – at least in terms of generating research and candidates. Most if not all firms were ready to or already doing video-based interviews – not overly disruptive.”

The COVID-19 Impact on Executive Search

The COVID-19 Impact on Executive Search

Over the past two weeks, recruiting software provider Thrive also interviewed dozens of leaders, CEOs, founders, and managing partners from top executive search firms. They candidly shared how COVID-19 and the resulting social and economic impact will affect the executive search sector. While many executive search leaders are optimistic that the crisis will be short lived, nearly all agree that the severity will be high.

“Search firms are hoping for the best, but preparing for the worst — redoing their planning and forecasts, reducing budgets, and revising cash flow plans,” said J. Reed Flesher, founder and president of Thrive.

Mr. Clarke said that while Kensington still has new searches coming in, virtually all of them are in the PE vertical and across industrial, healthcare services information/data security. All of the firm’s sectors, however, have been impacted – healthcare services, industrial, consumer and infrastructure/construction — to a certain or large extent. “Since the shutdown – we have seen engagements placed on hold across public, private and private equity verticals,” said Mr. Clarke. “What’s interesting is that no existing engagements have been outright canceled – they are either being slowed or placed ‘on-hold’ outright.”

Mr. Vancini cited seven key takeaways from the leaders on the calls:

1) Team: Stay close to employees. No communication is negative communication. A number of the CEOs mentioned daily “Zoom huddles” and virtual happy hours. Share the good news, said Mr. Vancini. “Reassure your team as best you can while keeping things honest.”

2) Working remotely: Most CEOs said they were pleasantly surprised by the productivity increases from people working remotely. “Some of the old-fashioned brick-and-mortar type leaders said they can’t believe the productivity they’re getting with the workforce remote,” said Mr. Vancini. “The key is the diligent updating of information in their search platform. Keeping information current and up to date is essential.”

Related: Leveraging Existing Response Plans to Tackle COVID-19

3) Candidate and clients: Stay close to clients and candidates. Several CEOS organized similar conference calls with their own clients. At least two firms organized webinars for candidates.

4) Expenses: Look for ways to reduce costs. “Many CEOs are going line by line in the budget and cutting what they can,” said Mr. Vancini. “Seeking rent relief from landlords can be an option. Staff reductions also might be in order (as a last resort) if the firms hired ahead of revenue.” Looking forward, some of the leaders said they might work to build more elasticity into their expense model.

5) Diversification: Explore opportunities in booming industries, such as telemedicine, consumer products, life sciences and healthcare, among others. Outplacement businesses may be in order. Some firms might also consider leadership development services.

6) Interviewing: “Make as much of the interviewing process as virtual as possible,” said Mr. Vancini. “If face-to-face interviewing is mandatory, have that be the last and final step.”

7) Planning: Many of the CEOs emphasized the importance of “what if” financial modeling should business decrease 10 percent, 25 percent, 50 percent or more. “What are your actions plans and trigger points?” said Mr. Vancini. Access to capital is key for survival. “Many firms may not survive a prolonged downturn,” he warned. “Firms should keep their finger on the pulse of everything happening in the business: new signings, AR, cancelations etc. Be ready to act quickly.”

“It’s about being planful, its about not burying your head in the sand, and making sure that your firm has its own unique plan on how to survive this, whether that’s to diversify into other industries, to look at scaling back, building as much elasticity into the expense structure, or whatever works best for you,” he said.

Related: Managing Through the COVID-19 Pandemic

Contributed by Scott A. Scanlon, Editor-in-Chief; Dale M. Zupsansky, Managing Editor; and Stephen Sawicki, Managing Editor – Hunt Scanlon Media